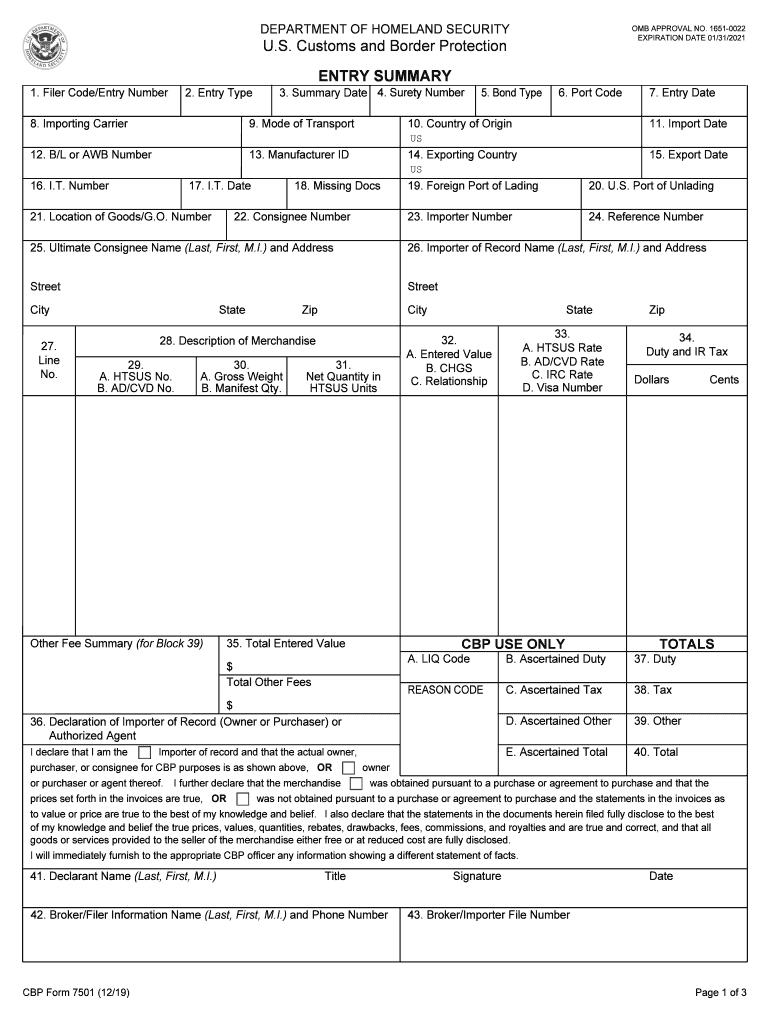

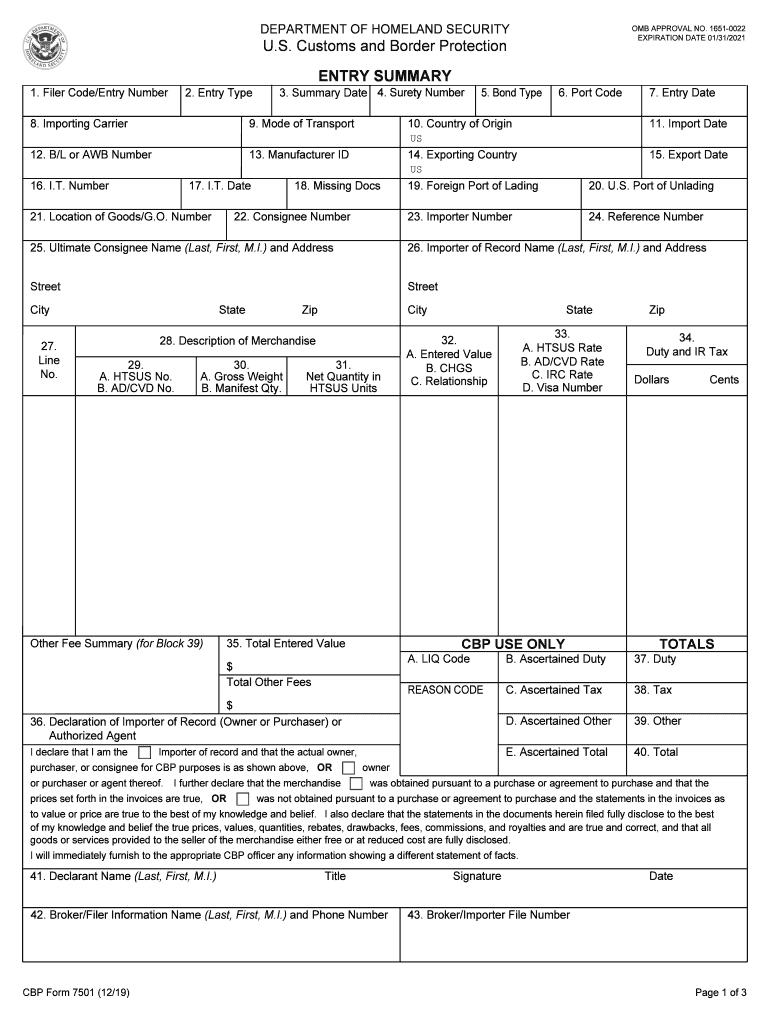

CBP 7501 2019-2024 free printable template

Get, Create, Make and Sign

How to edit form 7501 example online

CBP 7501 Form Versions

How to fill out form 7501 example 2019-2024

How to fill out form 7501 example

Who needs form 7501 example?

Video instructions and help with filling out and completing form 7501 example

Instructions and Help about 7501 cbp form

In this lesson were going to go over the 7501 basics the 7501 is broken into three distinct areas the top part of the screen is for the summary information so as you're doing your invoices and your HCS lines it is accumulating those values, and it will show you the total value the total weight and the total charges as you're doing your work, and then you can see on the right-hand side of the screen it has the HF and MPH checked off as needed the informal fees and all of that is built-in if you did check the ref in the base file entry then it would check here so that you'll always know that you did do, or you set the system up to do a ref entry the middle of the screen is the invoice information and this is where you do enter the invoices separately and then at the bottom of the screen is where you're going to put in your HTS numbers and well go through that right now so were going to do a basic entry and were going to put number one because this is going to be our first invoice so if you had a second invoice once you're done with the first one you would put a number two there three four so on and so forth if you have seen our other training videos or have used our tool you'll know that whenever you see a down arrow that means there's more information so for the pay type you have your insurance CIF or GDP entries, so you would put in whatever type of entry that you're working on then were going to enter our commercial invoice number then it takes us down to the currency we default US dollars but here's where you would put in whatever the foreign currency is Japanese yen or again whatever it is the system will go out, and it will find the exchange rate based on the export date that you put in the base file there is a video on currency exchange available to you now were going to put in the value of this particular invoice if we had any non-dutiable charges they would go there now well put in our weight put it now were going to go enter a product or a tariff number so if you did have products in the system and there is a video on how to enter products it's a great feature I recommend all of you looking at that video on how to enter the product codes so in this case we will choose the electronics product code, and then you see that the system now is able to pull the HTS number in the country of origin the country of export and then your you're one step ahead of the game as you go and put in your values so now well put in the line value and in this case well put in 40000 were going to do a two line entry the weight and the charges defaults for you notice here there's an X here which means there's no net value necessary or actually no other value necessary for this particular tariff number we have our tariff rate, and you can also see the tariff rate on the right-hand side of the screen here's where you can put in your mi d based on the M idea itself you can look it up by the name of the mid-50s then the system will pop up a window showing you or...

Fill 7501 form : Try Risk Free

People Also Ask about form 7501 example

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 7501 example 2019-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.